With President Obama and SEC Chairman Mary Schapiro called for increased penalties for violators of securities laws; it seemed prudent to check if this would actually protect the investing public. Professor Cornelius Hurley, director of Boston University’s Center for Finance, Law & Policy, supports the escalation in fines. “Companies will think twice about committing fraud if they can’t settle for chump change,” he said.

Hurley’s preferred reform would be to combine the SEC and CFTC. Combining the two agencies would save money by eliminating the duplication of oversight and allow for a more efficient deployment of a staff and other resources. “The collapse of MF Global suggests that we are paying a price for not combining the CFTC and SEC, which was suggested in a white paper about financial reform developed by the Treasury Department soon after Obama arrived in town,” he said. “Anyone can see that an organizational chart where two regulators are regulating the same space is absurd.”

Unfortunately, the greed of members of Congress killed the unification efforts. “The House and Senate Financial Services Committees oversee the SEC while the Agriculture Committee administers the CFTC. Members of the agricultural committee did not want to lose the tremendous contributions to their campaigns from the commodities firms,” explained Hurley. He marvels at the hypocrisy of the Republican Party for championing the free market discipline, yet be against any efforts to increase transparency.

Former NY Governor Eliot Spitzer emphasized a different solution. “The days of the neither admits nor denies must be over.” Neither admits nor denies is the controversial, decade’s long SEC practice of not extracting a confession from guilty parties in a settlement so that they can encourage settlements and avoid lengthy and costly trials against well-funded defendants.

Spitzer, known as the “Sheriff of Wall Street” during his tenure as NY State Attorney General, lauded Federal Judge Jed Rakoff for rejecting a proposed SEC settlement of Citigroup’s securities fraud charges partially over the lack of an admission of guilt on the part of repeat offender Citigroup. “We need more judges like Jed Rakoff that do not rubberstamp the SEC’s deals,” he said.

Hurley hopes the New Jersey federal judge overseeing the settlement of securities fraud by Wachovia, now Wells Fargo, considers the Rakoff decision when making her own decision. Although the Department of Justice insisted on an admission of guilt for the Wachovia settlement, the SEC inexplicably still used their boiler plate language of “neither admits nor denies.” Hurley said, “It defies logic that the two agencies can produce such different settlements."

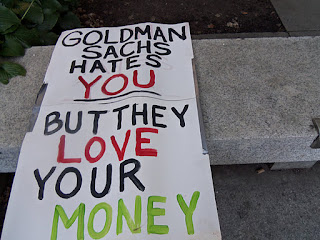

The one problem with the elimination of “neither admits nor denies” is that it is difficult to sanction corporations that provide jobs for thousands of people. Spitzer conceded, “One of the Occupy Wall Street signs made the point – “Until the State of Texas executes a corporation, corporations are not people”. You cannot just kill Citibank.”

Under the current system, it is the shareholders, not the corporate executives that committed the wrongdoing, that bear much of the financial pain of a corporation’s malfeasance. Spitzer wants to change that. “There must be individual responsibility. “Right now, the SEC now uses restitution as a proxy,” said Spitzer. “Executives of corporations must be held accountable for the corporation’s bad behavior.”

Besides no allocution of guilty behavior, the SEC settlement required Citigroup to only pay $285 million -$160 million for disgorgement of profits and $125 million in fines. Goldman Sachs for a similar offense paid $535 million in penalties. Spitzer and many others were shocked at this light punishment for repeat offender Citigroup.

“The issue of corporations’ recidivism must be addressed,” he said. “When I was an assistant district attorney, I worked in the career criminals unit. Those that had committed more than two felonies were punished more severely. They were sent away for a long time. For corporations that repeatedly offend, we need to increase exponentially the financial penalties and insist on structural changes such as compensation.” He urges the SEC to drop standard practice and use creativity to tackle recidivism.

None of the experts contacted thinks that there needs to be additional laws or new agencies to regulate the financial industry. Barbara Roper, director of investor protection at the Consumer Federation of America, just wishes that Congress would increase the budget of the SEC.

Spitzer urges the SEC to be more aggressive. “If Congress does not like it, take your case to the public,” suggests Spitzer. “The SEC has enough power. They just need the will to use it.”

Hurley pointed out that the collapse of MF Global violated long existing securities laws about customer account segregation not newer regulations like Dodd Frank. “Regulation is about individuals, culture. Former Federal Reserve Chairman Alan Greenspan could have protected the mortgage borrower with powers given to him in the Home Owners Equity Protection Act had he been a different person – not a free market champion and devotee of Ayn Rand,” he said.

He was reserved in his praise for the current group of regulators. He was happy to see that Shapiro is changing the SEC culture by hiring more financial professionals to investigate fraud. Yet there was no reason for her to do Wall Street's bidding by lobbying successfully to exclude brokerage firms from the oversight of the Consumer Financial Protection Bureau. Hurley wonders how CFTC Chairman Gary Gensler, a former Goldman Sachs colleague of former MF Global chairman Jon Corzine, “could have seen no conflict of interest while regulating MF Global but now that the CFTC is investigating wrongdoing he suddenly has a conflict of interest.”

Spitzer may have summed up the problem with the SEC best. “Whenever I was down there, I could not wait to get out of there.”